Debt Settlement Program

Our Debt Settlement Program allows clients the opportunity to settle all of their outstanding unsecured debts for a fraction of the overall amount. Our typical settlements are able to reduce debts by approximately 50%. For example, an account with a $30,000 balance may be able to be negotiated down to $15,000, or lower.

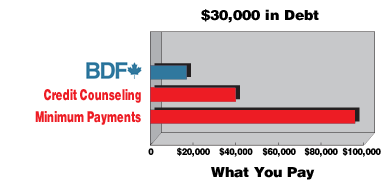

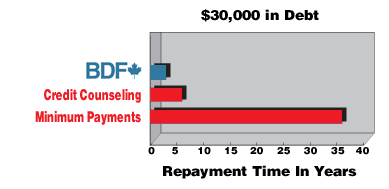

By reducing your overall debt amount you are not only saving money, but getting out of debt faster. Below is a comparison chart to give you an idea of how much faster our settlement program can get you out of debt.

Program overview:

Step 1:

Arrange a free consultation by either completing our request form or contacting us at 1-877-294-7247. We will go over your unique financial situation and determine if you are eligible for this program.

Step 2:

If accepted into our program one of our certified debt specialists will complete a financial assessment to help determine an affordable monthly dollar amount that will be used to save towards a negotiated settlement. This amount is usually significantly less than your current minimum payments, and will go towards paying off your debt (instead of interest charges). This amount will be deposited every month in a special savings account that you set up and have complete control over.

Step 3:

Once you have enrolled in to our Debt Settlement Program we will contact your creditors and advise them that all future communications pertaining to your debt(s) are to be handled by us. We will do everything within our power to avoid creditor harassment and ensure collection calls are stopped. You will be advised to avoid using credit during the duration of the program.

Step 4:

After sufficient funds have accumulated to make settlement offers, we will begin negotiating settlement amounts with your creditors individually. On average settlement amounts are approximately 50% of your current balances. It is important to note, it could take several months of savings before we are in a position to make settlement offers depending on the specifics of your financial situation.

Step 5:

When an acceptable settlement is negotiated with a creditor, we utilize the funds that have accumulated in your special savings account to pay off your creditor. Once the creditor has been paid you will receive a release letter which is written confirmation that your account has been satisfied and you no longer owe anything on the account. We will repeat this process until all of your accounts have been satisfied.

Step 6:

Once you have successfully completed our program we will provide you with proven strategies for improving your credit rating and keeping your newly found Financial Freedom.

To determine if you qualify for our Debt Settlement Program and to obtain a Free savings quote Call us Toll Free at 1-877-294-7247.